FOODIE, DIGITAL MARKETER

2 articles

September 27, 2019

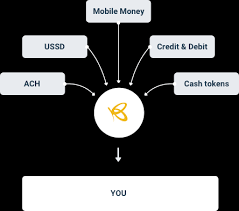

Flutterwave click here is a technology that uses digital payments infrastructure that assists banks and businesses to build seamless and secure payments for their customers or you can say it is a Payment API that makes it easier for banks and businesses to process payments across Africa and the world. Flutterwave mission is to inspire a new wave of prosperity across Africa by building a payment infrastructure that will connect Africa to the global economy. Just imagine if you could get your clients’ invoices paid two or even three weeks sooner. Multiply that across a year’s worth of invoices and you could unclog cash flow bottlenecks that have held the business back for years. Sounds awesome right? I know!

The Story Behind Flutterwave Origin; In time pasted especially in Nigeria, clients weren’t getting paid on time due to the old ways of payment/money transactions. Small businesses got slammed over late payment. A lot of invoices go past due — many of them by several weeks. This resulted in: difficulty paying bills, making payroll, or growing the business and also shatters confidence and removed the fun out of business.

This was why In 2016 Iyinoluwa Samuel Aboyeji a Nigerian entrepreneur and co-founder of Andela, after discovering that the payment challenges in Africa contribute to the fledgling e-commerce market and there were challenges with sending money into Africa and had to process payment every one to three months in order to avoid incurring too many fees. It also took at least a week to transfer money to local bank accounts. So he teams up with some individuals to create a payment gateway in Nigeria “Flutterwaveâ€.

“I believe that solving the payment challenges for merchant partners across the continent could unlock billions of dollars.â€

Iyinoluwa Samuel Aboyeji.

Payment Gateway. “A payment gateway is a service that sends all of your credit card transactions to your credit card processors, “It also sends you a message from your credit card processor that lets you know a transaction has been authorized. There are even some payment gateways that will automatically add tax and screen for fraud.†In other words, a payment gateway is simply a software application. It’s basically a conduit between an eCommerce website and the bank that authorizes (or declines) a customer’s credit card payment. Keeping Your Ecommerce Transactions Safe + Customers Happy.

“The evolving social and digital media platforms and highly innovative and relevant payment capabilities are causing seismic changes in consumer behavior and creating equally disruptive opportunities for business.â€

Howard Schultz.

As a Business or Ecommerce store

A payment gateway is the final step of the sales process on an eCommerce website. Without it, you won’t be able to securely charge your customers when they purchase items from your website.

Payment gateways online have never been so convenient.

They’ve also never been such an important target for hackers and scammers.

Companies relying on online payment processors may get hit the hardest.

Payment Gateways: Keeping Your Ecommerce Transactions Safe + Customers Happy (2019)

Payment gateways online have never been so convenient.

They’ve also never been such an important target for hackers and scammers.

Companies relying on online payment processors may get hit the hardest.

A 2018 Thales Data Security Report revealed that 75% of U.S. retailers have suffered at least one cybersecurity failure with their online stores.

In fact, Shape Security reported in 2018 that some 90% of total login attempts to online retailers’ websites were illegitimate hacking attempts.

That’s the highest percentage for any sector.

That’s why it’s important to understand that the quality of your eCommerce payment gateways helps you fend off these attacks in real-time, providing a buffer of encryption between buyer and seller.

High-quality payment gateways also help you reduce load time.

A payment gateway is a merchant service that processes credit card payments for eCommerce sites and traditional brick and mortar stores.

Why choose Flutterwave?

Flutterwave has processed $2.5 billion in payments, 100 million transactions, and is partnered with 50 African banks with over 1200 developers that build on the platform since its inception, also they have been able to raise over $20 million in investments.

Flutterwave In 2017, it extended its services by introducing a payment product called Rave. Rave opens businesses to more opportunities by allowing them to accept a range of payment methods from customers around the world. It creates any type of payment flow, from e-commerce to recurring billing and everything in between. Some of the companies that use Rave include Uber, Flywire, Arikair.com, Jumia, marketHub, and Booking.com.

Flutterwave serves some of the popular payment service providers in Nigeria including Paywithcapture, Paystack, AmplifyPay and many more. It also works with Access Bank, Uber, Bolt and Page Microfinance. Some of the payment methods it supports include Visa, MasterCard, ApplePay, Verve, American Express, Android Pay and others. By the end of 2018, Flutterwave had processed $2.6 billion in transaction value.

In 2019, Flutterwave partnered with Visa to launch a consumer payment product called GetBarter. The product is aimed at facilitating personal and small payments within countries and across African borders. GetBarter allows Flutterwave, which has scaled as a payment option for big companies through its Rave product, to pivot to African consumers and traders. The payment product also creates a platform for clients on multiple financial platforms, such as Kenyan mobile money service M-Pesa, to make transfers across payment products and national borders, as well as being able to shop online.

Flutterwave has partnered with Chinese e-commerce company Alibaba’s Alipay to offer digital payments between Africa and China. Alipay is Alibaba’s digital wallet and payments platform. A large portion of Alipay’s network is in China, which makes the Flutterwave integration significant to capturing payments activity around the estimated $200 billion in the China-Africa trade link.

WORTHY OF NOTE: In 2017, Flutterwave raised $10 million in a Series A round of funding. Key investors at that time included Green Visor and Greycroft Partners. In 2018 it concluded an extension of its Series A funding round, with participation from global payments company MasterCard, CRE Ventures, Fintech Collective, 4DX Ventures, and Raba Capital, among others, and raised a total of $20 million. As part of the deal, Green Visor

Capital Chairman and General Partner and former CEO of Visa, Joseph Saunders, joined the Flutterwave Board of Directors. Through its investments, Flutterwave has also been able to raise over $20 million in investments.

Flutterwave is a Nigerian-founded B2B payment service (primarily) for companies in Africa to pay other companies on the continent and abroad.

List of Flutterwave Products:

RAVE : This is the easiest way to make and accept payments from customers anywhere in the world Building a business is challenging enough. It brings your business into the Flutterwave payment ecosystem where you’ll experience;

24/7 customer service

reasonable fees

and the technology

To achieve zero failed transactions. With Rave, you can easily Set up your business with speed, ease, and functionality, in order to provide your customers with the best possible checkout experience. Click here for Rave Sign up .

: Barter is designed to help you focus more on enjoying life and less on how to spend, spend and borrow money. We take care of making those happen. Manage payments & Subscriptions do it all from our app, download & sign up for free. click here : Barter login to get started.

OTHER INFO:

Sandra Mohammed.

Published by

FOODIE, DIGITAL MARKETER

2 articles

September 27, 2019

Reactions